Contact

About the Property Tax

Real Estate/Property Tax bills are typically mailed in late October to early November. Revenue generated by the property tax is the second highest revenue source for the City of Paducah generating an anticipated $9.54 million for Fiscal Year 2026. Only the payroll tax generates more revenue.

Note: The City government does NOT set the city or county school tax rates or assess a property's value. Property owners will receive a separate bill from the McCracken County Sheriff for County government and other agencies.

The bill has four bodies that receive revenue:

- City of Paducah

- Paducah Junior College

- 911 Services (labelled E911 on bill)

- School District. The school district depends upon where you live in the City. Some people live in the City but are in the McCracken County School District.

Payment Options

Payments for business licenses and property tax bills can be made online, in-person at City Hall, or over the phone at 270-444-8513. In addition to cash, check, and/or e-check, the City of Paducah accepts credit card payments.

- There is a flat fee of $1.50 per payment by e-check.

- A 3.75 percent service charge will apply on credit card payments. Payment types include Discover, MasterCard, and Visa. The City does not charge or retain this service charge. There is a $2.50 minimum per transaction.

View Property Tax Bills and Pay Online

Interactive Voice Response (IVR) System - The City of Paducah offers an Interactive Voice Response (IVR) System for the payment of property tax bills (real estate and personal property). This is a 24-hour service to pay property tax bills over the phone with a card or check without speaking to a finance agent. Services are offered in English and Spanish.

- There is a service fee of $0.50 per transaction in addition to e-check and credit card processing fees.

- Real Estate Tax IVR – 833-256-9146 (please have bill year and bill number ready)

- Personal Property Tax IVR – 866-800-3584 (please have bill year and bill number ready)

2025-2026 Tax Rates

For fiscal year 2025-2026, the City’s real estate tax levy is set to be 27.1 cents per $100 assessed value. This means that for every $100 of assessed value of real estate, $0.271 (slightly more than a quarter) is paid to the City of Paducah.

Note: For many years, the City has collected the school's taxes and passed along the funds to the district. Even though the school's taxes are on the same bill as the City's taxes, the City does NOT set the school district’s rates.

How to Calculate Your Property Tax

|

|

City |

PJC |

||

|

|

Tax Levy |

Revenues |

Tax Levy |

Revenues |

|

Tax Year 2025-2026 |

$.271 |

$6,961,000 |

$.014 |

$360,000 |

|

Tax Year 2024-2025 |

$.264 |

$6,546,000 |

$.014 |

$347,000 |

|

Compensating Rate |

$.261 |

$6,704,000 |

$.014 |

$360,000 |

|

New Real Property |

|

$157,000 |

|

$8,100 |

|

Personal Property |

|

$610,000 |

|

$22,000 |

Due Dates

The due dates for the real estate/property tax bills are outlined in Chapter 106 of the Paducah Code of Ordinances. Property taxes levied herein shall be due and payable in the following manner:

- In the case of tax bills which reflect an amount due of less than $2000.00, the payment shall be due on November 1 and shall be payable without penalty and interest until November 30. (For 2025 bills, the deadline is December 1, 2025.)

- In the case of all other tax bills, payment shall be in accordance with the following provisions:

- The first half payment shall be due on November 1 of the tax year and shall be payable without penalty and interest until November 30. (For 2025 bills, the deadline is December 1, 2025.)

- The second half payment shall be due on February 1 of the following year and shall be payable without penalty and interest until February 28. (For 2025 bills, the deadline for the second installment is March 2, 2026)

Frequently Asked Questions

- Who determines the value of my property?

-

The McCracken County Property Valuation Administrator (PVA) is responsible for setting property assessment valuations for property tax purposes. The PVA can be reached by contacting Property Valuation Administrator Bill Dunn at 270-444-4712 or by visiting the PVA Website.

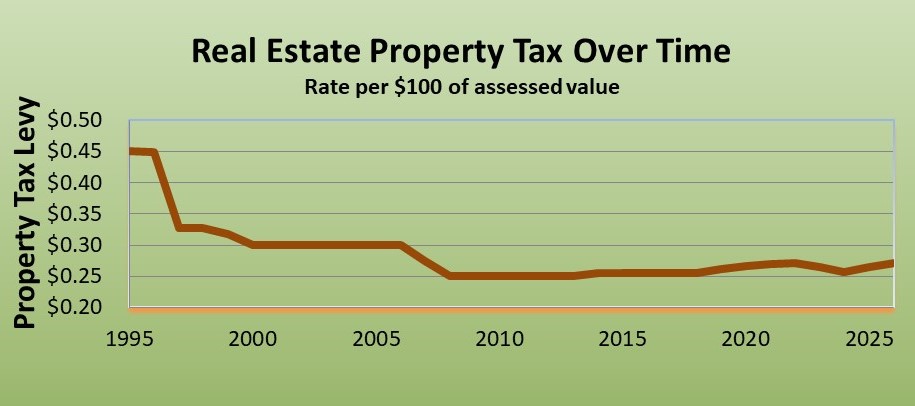

- How has the City of Paducah’s property tax rate changed in the past 25+ years?

-

Back in 1995, the tax rate was slightly more than 45 cents per $100 assessed value. That made up about 41% of the tax bill. But with the conscious effort over the past several decades to get it down to the current rate, our portion of the tax bill is now less than a quarter.

- How does property tax rank with other City revenue sources?

-

Property Taxes generate more than $9.5 million per year. It is the City's second largest revenue source with payroll tax as the City's number one source.

- What are the other entities on the property tax bill?

-

According to Kentucky Revised Statutes, we must collect the tax for the Paducah Independent School District. However, the school board sets the tax rate. We simply pass the funds along to them. We also collect the tax for Paducah Junior College, Inc. which is associated with West Kentucky Community & Technical College. So we collect for three entities but keep only a small portion of the total bill.

- If my house is assessed at exactly the same value as my neighbor’s house, is it possible to have a different amount on my tax bill?

-

Yes, it is possible since it depends on which school district you live. Most of the western end of Paducah is in the McCracken County School District. That means on the border between the two districts, houses across the street from each other could be in different districts.

There are fewer households in the City that are in the County school district; however, the households that are in the County school district make up more than half of the total assessed values for properties within the city limits.

Property Tax Rate History

- For the City's real estate property tax levy history since 1995, visit Real Estate.

- For the City's personal property tax levy history since 1995, visit Personal Property Tax.

- For the Inventory Property Tax History since 1995 for the Paducah Independent School District, visit Inventory Property Tax. The City of Paducah discontinued the Inventory Property Tax in 2003.

Abandoned Urban Property Tax (AUPT)

In December 2025, the City created a new section in Chapter 106 of the City’s code for the taxation of properties classified under Kentucky law as abandoned urban property. This process, which is authorized by KRS 92.305 and KRS 132.012, is intended to address long-term vacant and neglected properties. To be classified as an “abandoned urban property,” the property must be vacant or unimproved for at least one year and meet one additional condition (e.g., unfit for human habitation, unsafe or unsanitary, declared an unsafe structure, contaminated, exists in a development area established under KRS 65, or tax delinquent for three or more years).

This Abandoned Urban Property Tax (AUPT) applies to both residential and commercial properties, including vacant lots, if they meet the statutory definition. The AUPT is in lieu of the City’s regular property tax rate. The rate is $1.50 per $100 of assessed value.

The annual steps are below:

- Each year, the City will compile a list of properties that meet the definition as abandoned urban property.

- The list will be reviewed and approved by the Code Enforcement Board.

- Affected owners will be notified and will have an opportunity to file an appeal before the rate is applied to their tax bill.